Politics, a struggling economy, a global pandemic, and natural disasters: How you can stay the course with your finances during this tumultuous time?

By Tom Williams, CEO of Domani Wealth

You will not hear the words “2020” and “smooth” in the same sentence.

This year has been nothing but a roller coaster ride. From navigating a global healthcare pandemic, the likes of which haven’t been seen in a century, to closely following a race to develop a vaccine, and then to managing the constant revelations during a presidential election. On top of all that, the stock market has been volatile.

The result of this ongoing, constantly changing information is that it makes us feel very nervous about what’s going to happen in the future. And not just related to one of those areas – election, more waves of infections as winter arrives – but also, with our own lives. How will the markets affect my finances? Will I be ready for retirement after a year like this?

Elections

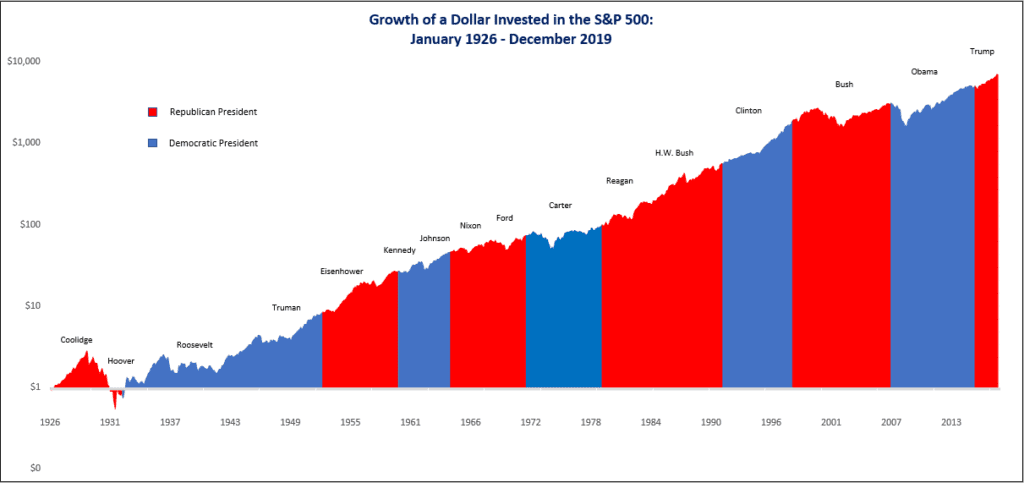

Historically, election results contribute to only short-term volatility. There is no real correlation between a presidential election outcome and the returns of the stock market. Many other factors have a longer-term impact on the capital markets, such as corporate earnings, economic growth, investor emotions/behaviors, geopolitical events, etc. Capital markets and economic growth tend to increase over time, in spite of interim volatility.

We will always have some volatility in the capital markets, simply because many different world and national events affect them. Trying to time the market to avoid volatility can be a losing game. Not only must investors determine when to exit the stock market, but also when to buy back into the market. Staying focused on your long-term financial goals is helpful during a time like this.

Pandemic

An example of trying to time the market occurred earlier this year when COVID-19 began to create much volatility while the disease began to steadily spread in the U.S. As the markets began falling, many investors panicked and sold out of their equity holdings.

If an investor would have exited the market on March 13 of 2020, the day President Trump declared COVID-19 a national emergency, they would have locked in negative returns of -15.7 percent for 2020, based on the S&P 500 Index.*

However, an investor who remained fully invested throughout 2020 would have realized returns of more than 5.6 percent year-to-date through Sept. 30, based on the same index.**

Tax Planning

In 2020, tax planning has been of paramount importance. As the possibility for a shift to Democratic leadership on the national stage may occur both in the White House and in the Senate, the possibility also exists that leadership may increase both income and estate taxes.

However, regardless of which party prevails in leadership during the 2020 election, taxes are likely to increase over the next few years, in part to manage the extraordinary government spending that has taken place this year to help businesses and individuals navigate the economic shortfall from managing the pandemic.

End of Year

As we continue marching toward the end of 2020 (thank goodness!), we encourage you to move forward with a sense of calm. While we may see some short-term market volatility because of these world-changing events, the market typically rewards investors with a long-term viewpoint.

Footnotes

*Year-to-date return through March 13, 2020 represents total return of the S&P 500 Index per Bloomberg for dates 12/31/2019 through 3/13/2020.

**Year-to-date return through September 30, 2020 represents total return of the S&P 500 Index per Bloomberg for dates 12/31/2019 through 9/30/2020.