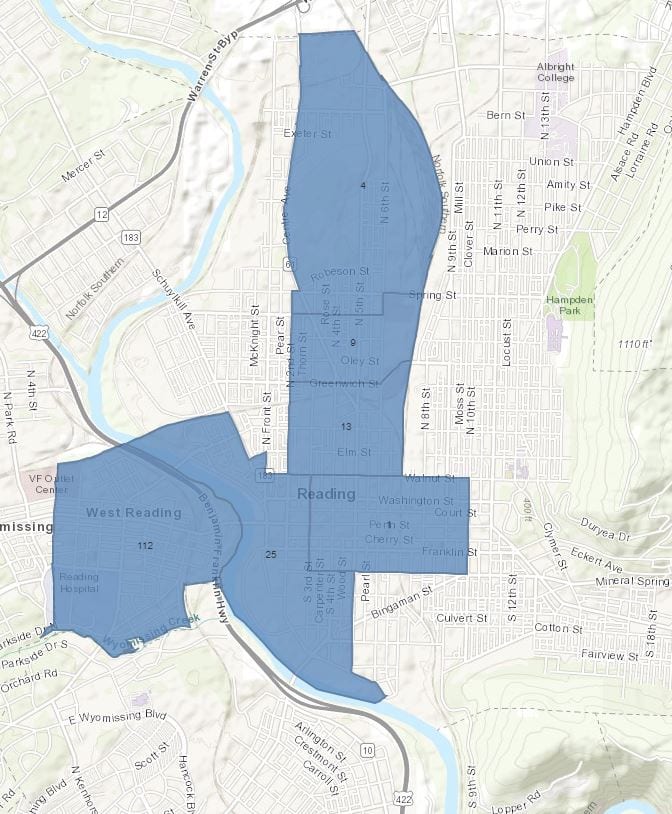

GREATER READING OPPORTUNITY ZONES

In December 2017, the United States Congress added a new economic development tool called Opportunity Zones to the tax code through the Tax Cut and Jobs Act of 2017. Opportunity Zones provide federal tax benefits to investors who make equity investments from realized capital gains in qualifying development projects or businesses within low-income communities.

The 6 section zone used for Berks County’s Opportunity Zone.

Opportunity Funds are investment vehicles organized as a corporation or partnership for the purpose of investing in Opportunity Zones. Opportunity Funds can self-certify and must invest at least 90% of their capital in qualifying Opportunity Zone investments. Eligible investments in Opportunity Zones may include commercial real estate development and renovation, opening new businesses, and expansion of existing businesses.

Investing realized capital gains into Opportunity Zones has many benefits for individual or corporate taxpayers, including:

- Deferral of federal tax payment on initial capital gain until the earlier of the sale of the Opportunity Fund investment or December 31, 2026.

- Partial exclusion from federal tax of the original capital gain through a step up in basis if the Opportunity Fund investment is held for 5 years (10%) or 7 years (15%).

- Full exclusion from federal tax of any new capital gain if the Opportunity Fund investment is held for 10 years or more.

The Greater Reading Chamber Alliance (‘GRCA’) will focus on three immediate-term strategies:

-

ATTRACT: GRCA will market the Reading & West Reading OZ area to ATTRACT Opportunity Zone investments.

Investors who want to take advantage of the tax benefits can invest their capital anywhere. The challenge will be to attract investors to projects in our Opportunity Zone.

GRCA will develop relationships with Opportunity Zone fund managers and prospective investors to attract local, regional, and national equity capital to Reading/West Reading.

-

CONNECT: Our goal is to CONNECT equity capital to projects and businesses located in Reading/West Reading Opportunity Zones.

In order to succeed in connecting capital to Reading/West Reading’s Opportunity Zone, there must be investment-ready projects and businesses. GRCA is currently tracking potential projects in various stages of development. Through the relationships we develop with Opportunity Funds and investors, GRCA will endeavor to make those connections.

-

3. ALIGN: GRCA will ALIGN other resources to provide gap-filling capital for high-impact projects and businesses in the Opportunity Zone.

The Opportunity Zone tax incentive has no restrictions on project type or on the community impact that investments must produce. In the absence of these requirements at the federal level, GRCA will develop local impact screening to evaluate the economic and community impact of projects located in the Opportunity Zones. For significant projects, GRCA will strive to offer capital, through its own or other resources, that would complement Opportunity Fund equity investments in order to fill gaps in the capital stack.